I get questions all the time from federal employees all around the country (and the world) about the TSP (Thrift Savings Plan) and IRAs.

Some of these questions include:

-What are the pros and cons of investing in IRAs over the TSP?

-Can I invest in both the TSP and an IRA?

-Can I roll my traditional IRA into my TSP?

-Can I invest in an IRA if my income is high?

-Should I roll my TSP into an IRA once I retire?

-Should I keep my money in the TSP once I retire?

-Are the investment fees for IRAs higher than the TSP’s?

-Should I invest in the Roth TSP?

-How does the Roth TSP compare to a Roth IRA?

And all these questions are totally understandable. After all, these two types of accounts are by far the most used retirement accounts for employees of the federal government.

If you have ever asked one of these questions, then you are in the right spot.

Because while both the TSP and IRAs are designed to help you save for retirement there are still significant differences and pros and cons to either choice.

Let’s break this large topic down into some of its parts.

Traditional TSP vs. Traditional IRA

The first thing to compare is the traditional TSP to a traditional IRA.

Both of these accounts are pre-tax accounts which means that you don’t pay taxes when you put money in but you do when you take money out in retirement.

As a simplified example, let’s say that you had $50,000 of taxable income from your job last year. If you would have invested $5,000 into either the traditional TSP or a traditional IRA, your taxable income would have been only $45,000. You are essentially deferring the taxes on that income until a later time.

But let’s say that the $5,000 that you invested into either account grew to $20,000 over the next 20 years at which point you retire. When you withdraw the $20,000 in retirement the entire amount will be subject to taxes and not just the initial $5,000 that you invested.

Related Topic: How to Never Lose Money in The TSP

The Match

One major difference between these two accounts is that as federal employees, your agency offers matching contributions if you invest in the TSP. Basically, your agency will contribute money into your TSP account based on how much you are contributing. There is no match when you invest in an IRA.

This charts shows how the match works:

Contribution Limits

Another big difference between the TSP and IRAs is how much you can contribute every year.

As of 2021, you can invest significantly more into the TSP compared to IRAs. This chart shows the contribution limits for 2021.

Am I Allowed to Contribute to Both a traditional IRA and the traditional TSP?

The short answer is yes you can. The long answer is that once your income surpasses certain limits then you won’t be able to deduct your IRA contributions if you or your spouse is also enrolled in an employer sponsored plan (ie. the TSP).

This next section goes through this in detail.

Traditional IRA Contribution Deduction Income limits

When you contribute to the traditional TSP or a traditional IRA you are generally able to deduct these contributions on your taxes. This is always true for your TSP contributions.

However, once your income surpasses certain limits you may not be able to deduct your IRA contributions.

The rules will be different depending on which of the 2 categories you fall into.

No Retirement Plan at Work: If neither you and your spouse is covered under a retirement plan (ie. the TSP, 401k, 403b) then your traditional IRA contributions will always be tax deductible no matter your level of income.

Retirement Plan at Work: If at least one spouse is covered by a retirement plan at work then there are income thresholds for IRA deductions.

These charts break down these thresholds per your tax filing status.

If You Are Covered by a Retirement Plan at Work

If Your Filing Status Is… | And Your Modified AGI Is… | Then You Can Take... |

single or head of household | $66,000 or less | a full deduction up to the amount of your contribution limit. |

more than $66,000 but less than $76,000 | a partial deduction. | |

$76,000 or more | no deduction. | |

married filing jointly or qualifying widow(er) | $105,000 or less | a full deduction up to the amount of your contribution limit. |

more than $105,000 but less than $125,000 | a partial deduction. | |

$125,000 or more | no deduction. | |

married filing separately | less than $10,000 | a partial deduction. |

$10,000 or more | no deduction. | |

If you file separately and did not live with your spouse at any time during the year, your IRA deduction is determined under the “Single” filing status. | ||

Source: https://www.irs.gov/retirement-plans/2021-ira-deduction-limits-effect-of-modified-agi-on-deduction-if-you-are-covered-by-a-retirement-plan-at-work

If You Are NOT Covered by a Retirement Plan at Work

If Your Filing Status Is… | And Your Modified AGI Is… | Then You Can Take… |

single, head of household, or qualifying widow(er) | any amount | a full deduction up to the amount of your contribution limit. |

married filing jointly or separately with a spouse who is not covered by a plan at work | any amount | a full deduction up to the amount of your contribution limit. |

married filing jointly with a spouse who is covered by a plan at work | $198,000 or less | a full deduction up to the amount of your contribution limit. |

more than $198,000 but less than $208,000 | a partial deduction. | |

$208,000 or more | no deduction. | |

married filing separately with a spouse who is covered by a plan at work | less than $10,000 | a partial deduction. |

$10,000 or more | no deduction. | |

If you file separately and did not live with your spouse at any time during the year, your IRA deduction is determined under the “Single” filing status. | ||

Source: https://www.irs.gov/retirement-plans/2021-ira-deduction-limits-effect-of-modified-agi-on-deduction-if-you-are-not-covered-by-a-retirement-plan-at-work

Traditional TSP and Traditional IRA Withdrawal Rules

Another big difference between the traditional TSP and traditional IRA is when/how you can take money out in retirement.

For most retirement accounts, there is a 10% penalty if you take out your money before age 59 and ½. The distribution may be subject to taxes as well.

However, if you retire from federal service after age 55 you are able to access your traditional TSP without this 10% penalty. If you are under the FERS special provisions then this will be age 50. And like always, money taken out of your traditional TSP will be subject to taxes.

What is important to know is that traditional IRAs don’t waive this 10% penalty for those that retire after age 55 (or 50 for special provisions). IRA owners still have to wait until 59 and ½.

So if you are retiring in your fifties but before age 59 and ½ then there is often an advantage to keeping your money in the TSP and not rolling it into an IRA (until at least 59 and ½).

TSP Investment Fees Vs. IRA Investment Fees

Investment funds such as the C,S, I, F, and G funds cost money to run and the TSP covers these costs through charging fees. The good news is that the TSP fees are very low at about 0.04%.

This means that for every $1,000 that you have in the TSP, you pay 40 cents every year in investment fees.

But if we look at the funds on the private side (outside the TSP), we find the investment fees can easily be between 0.5%-2% to invest in an index fund or mutual fund. In the extremes, this means that you could be paying up to 50x to invest in certain funds compared to the TSP funds.

But as a financial planner myself who often charges fees, I am certainly not opposed to fees in general. Some things are 100% worth paying for.

The question that we all have to ask ourselves when buying anything (including investments) is if the product or service that I am receiving is worth the fees that I am paying. And unfortunately, the extra fees that we pay for expensive investment funds are often not worth it at all.

Many studies have shown that passive index-style investment funds, such as the funds in the TSP, often outperform those funds that have a more active strategy especially once we take the higher fees into account.

And the good news is that there are now many low-fee options on the private side as well. Vanguard and Fidelity have some great options to consider.

Related Topic: Which L Fund is The Best?

Can I Roll My Traditional IRA Into My Traditional TSP?

Yes, you are able to roll over a traditional IRA into your TSP during your career and even after you separate or retire from service.

Note: You can not roll a Roth IRA into your TSP even if you have a Roth TSP.

Should You Roll Your TSP Into An IRA after Retirement?

The TSP has served you well over a long career but now it is time to retire. My retiring clients often say things like “Is the TSP still the best option in this new stage of life? Some people talk about moving it to an IRA, but all I’ve known is the TSP. I’ve done well enough investing my TSP during my career but I really don’t know how I should invest in my retirement.”

Unfortunately, there is no black and white answer. There is not one single answer solution that fits the needs of every single federal employee out there. Everyone, (that means you too) needs to educate themselves enough to know the basic pros and cons of this decision because it can make a big difference over a long retirement.

To get you started, here are some things to consider.

An IRA is a great tool and is widely used by those working in the private sector. It is less common among feds however, because they have access to the TSP.

The main advantages of an IRA in retirement is the flexibility. You have much more wiggle room with withdrawal options as well as investment options. The one potential problem that comes with more choices is the complexity.

The TSP’s strength lies in the fact that it is so simple and easy to use. There are limited investment options, but they meet the needs of most feds just fine. Not to mention the fees are incredibly low. If you want to have more flexibility to withdraw and invest funds in more complex ways and you don’t mind the extra complexity then maybe an IRA is the right choice.

It is important to note that many financial advisors will tell you to roll your TSP into an IRA. This is not always a bad thing especially if you’d like your advisor to manage the account for you. Just remember that most advisors get paid to manage money. The more money they manage, the more money they make. Because advisors can’t directly manage your TSP they will often advise you to simply roll it out into an IRA so that they can manage it.

Now, I am not saying that all financial advisors will throw your interests aside just to make more money. There are many advisors out there who truly put their clients before themselves. As an advisor myself, I have definitely seen both the good and bad in the industry.

My advice to you is to not be afraid to ask your advisor when you don’t understand why he/she advises a certain way. An advisor that is worth their salt will be able to walk you through the reasons why a certain action makes the most sense for you in the long run.

Cons Of Keeping Your TSP

An IRA has one major advantage over the TSP. Flexibility. As long as you meet some basic criteria, you can withdraw money out of your IRA however you’d like. With the TSP however, there are a number of rules that control how and when you can take money out. Many people find it easier to control retirement income with an IRA over the TSP.

For example, when you distribute money from your TSP you can’t choose which funds it comes out of. It will come out proportionally from the funds that you are invested in.

Let’s say you have 50% of your money in the G fund and the other 50% in the C fund. If you take out $100 then $50 will come from the G fund and $50 from the C fund. This might be an issue if the market is down and you’d prefer not to sell the C fund until the market recovered.

Roth TSP vs. Roth IRA

Now that we have compared the pre-tax (aka traditional) sides of the TSP and IRAs now it is time to compare the Roth TSP and a Roth IRA.

They have a number of similarities and I get questions about both of them all the time. That being said, they have key differences that make a big difference in how the accounts can be used in practice.

So let’s get into the details…

The Similarities

Tax-Me-Now Accounts

This is often the most well known aspect of a Roth IRA or the Roth TSP. This means that you are only able to contribute after-tax money into these accounts. Unlike the traditional TSP or traditional IRA, you do not get a tax deduction for putting money into a Roth account.

But down the road in retirement (assuming you follow all the rules), you are then able to take money out of Roth accounts completely tax free. And one of the best parts is that you not only can access what you put in tax free, but you can also get all the money that your contributions had earned while in the account tax free.

For example, let’s say you contribute $100,000 into the Roth TSP over your career and you invest it into the C and F funds. At retirement time, your initial $100,000 contribution has grown to $200,000. You’d be able to access all $200,000 tax free.

Off Limits For 5 Years

Once you open a Roth IRA or start contributing to a Roth TSP, you have to wait at least 5 years to be able to access the earnings tax free.There are other withdrawal rules as well (like being at least 59 and ½) but this 5 year rule is often that one that gets forgotten.

For example, let’s say you start a Roth IRA at age 60 while you are still working. You retire at age 62 and are excited to have some tax free money in retirement. Even though you are older than 59 and ½, you’d still have to wait 5 years from the time you opened the account to be able to access your earnings tax free.

The Differences

Early Retirement Penalties

This difference applies to the traditional sides of the TSP which can affect how we use the Roth side.

Because of how the FERS retirement system is set up, many federal employees are able to retire before 59 and ½. This is a great thing but as I mentioned before, there can be penalties when touching retirement accounts before 59 and ½. The good news is that if you are 55 (50 for special provision FERS) or older in the year that you retire, you are able to access your traditional TSP (not Roth side) without the 10% penalty. However, this rule does not apply to Roth IRAs, traditional IRAs, or the Roth TSP.

For example, let’s say someone retires from the Fed at age 56. They would be able to access their traditional TSP without the normal 10% penalty that would normally apply before 59 ½. But if they chose to roll their TSP into a traditional or Roth IRA, they would not be able to escape the 10% penalty before 59 and ½.

A Few More Things

There are also a couple of other differences that I would be remiss to not mention.

First, the contribution limit for your TSP (traditional or Roth side) is $19,500 in 2020 and only $6,000 for a Roth IRA. This can make a big difference for those that want to get serious about retirement savings.

Second, when you invest in the TSP, you receive matching contributions from your agency. There are no matching contributions for a Roth IRA.

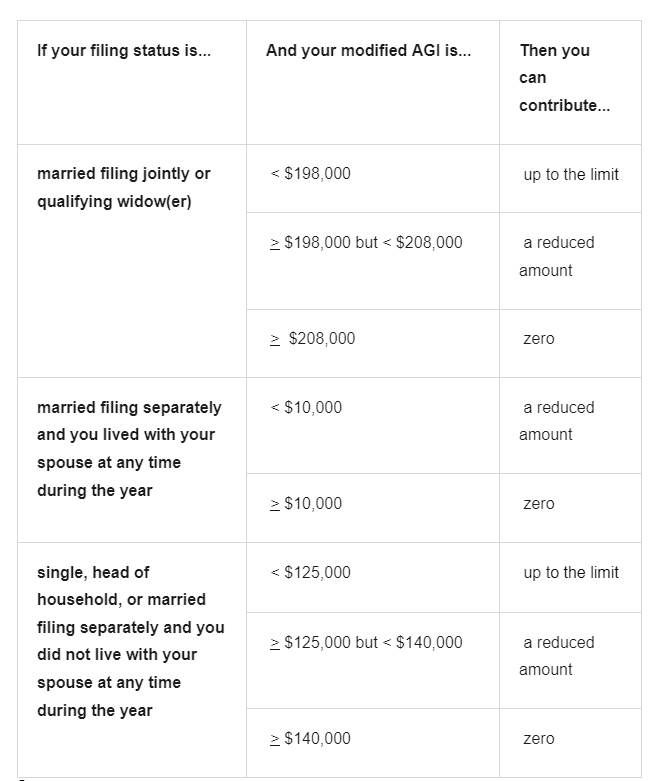

Third, once your income is over certain limits, you are no longer able to contribute to a Roth IRA. There are no such limits for a Roth TSP.

Here is a chart showing the income limits to invest in a Roth IRA in 2021.

Source: https://www.irs.gov/retirement-plans/amount-of-roth-ira-contributions-that-you-can-make-for-2021

So if your modified adjusted gross income is above the limits shown in the table above then it may be simpler to invest in the Roth TSP which doesn’t have income limits.

Related Topic: When You Shouldn’t Use The Roth TSP

Backdoor Roth IRA

But if you are a high-earner and would still like to get money into a Roth IRA there is a roundabout option. It is called a backdoor Roth IRA.

In a nutshell, a backdoor Roth strategy is used when you put money into a traditional IRA and then convert it into a Roth IRA. This works because while there are income limits to making direct contributions to a Roth IRA there are no income limits to converting money from a traditional IRA to a Roth IRA.

But as we mentioned earlier in this article, there are income limits for taking deductions for traditional IRA contributions. This means that once your income crosses certain limits you can still contribute to a traditional IRA but you won’t be able to claim a tax deduction for doing so.

But you might ask, why would you want to contribute money to a traditional IRA if you don’t get a tax deduction for doing so? Some people do so to then be able to use the backdoor Roth strategy.

Here is an example of how it could work.

Let’s say you have a traditional IRA and a Roth IRA which both have a balance of $0. Unfortunately you make too much money to put money directly into a Roth IRA and you also make too much money to deduct your traditional IRA contributions.

Because of this you decide to put $6,000 (the max for 2021) into your traditional IRA knowing that you won’t get a tax deduction for doing so. At that point you could then transfer that $6,000 into your Roth IRA and because that money was after-tax to begin with, you won’t have to pay taxes on the conversion.

The result is that you were able to get money into a Roth IRA despite being over the income limits.

Note: If you had taken a tax deduction for the original traditional IRA contribution then you will have to pay taxes when you transfer money to a Roth IRA

But there are certainly a number of things to watch out for.

The Pro-rata Rule

The pro-rata rule states that if you do a Roth conversion then the tax status of whatever you convert to a Roth IRA will be proportional to all the money you have in traditional IRAs.

For example, if you have $1,000 in your traditional IRA that is pre-tax and $1,000 that is post-tax then the IRS will assume that for every dollar that you convert over to a Roth IRA, half of it will be post-tax and half of it will be pre-tax. So if you decide to convert $1,000 from your traditional IRA to a Roth IRA then you will have to pay taxes on $500 of the conversion.

The pro-rata rule will still apply even if you have multiple IRAs.

For example, if you have one traditional IRA with $500 of pre-tax money and a second traditional IRA with $500 of post-tax money then regardless of which IRA you convert to a Roth IRA the IRS will count half of the conversion as taxable because that is the proportion across all your IRAs.

However, one way to potentially get around this is by moving all your pre-tax traditional IRA money into your traditional TSP. This would then allow you to convert any amount of post-tax money into a Roth IRA without tax consequences.

The Five-year Rule

Whenever you do a Roth conversion it starts a 5-year clock. If you distribute the conversion principle within the 5 years then it may be subject to a penalty if you are still younger than age 59 and ½.

Conclusion

And if you have made it to the end of this article I am sure that you now know that there are a number things to consider when deciding where to save for retirement. There many things to think about and you will have to take a hard look at your own situation to know what makes sense for you.