With more than 30% of all federal employees having some sort of military time, knowing if you should buy back your service time is more important than ever. And I have seen how this one decision can make a dramatic difference in when and how federal employees can retire.

But just like many topics in the federal government, there are a lot of things to think about when looking at buying this time back.

Here are links to the main sections of this guide so feel free to jump to the area that you need.

What is Buying Back Military Time?

Benefits of Buying Back Military Time

How Much Does it Cost to Buy Back Military Time?

How to Buy Back Time Without Interest?

Pros and Cons of Buying Back Military Time

Should You Buy Back Your Military Time if You Have a Military Retirement?

How to Buy Back Your Military Time?

Can I Buy Back Military Time After Retirement?

Does Bought Back Military Time Count for The FERS Supplement?

Can I Buy Back My Reserve or National Guard Time?

Can I Buy Back My Academy Time?

What is Buying Back Military Time?

Buying back military time (or making a military service deposit as some call it) is basically paying a certain amount of money to add the time you had in the military to your federal service.

Buying back your time often makes the most sense when you are not already receiving a military retirement/pension. If you are receiving a military retirement then you will want to check out the “Should You Buy Back Your Military Time if You Have a Military Retirement?” section below.

Benefits of Buying Back Military Time

And as many of you know, having more years of creditable service has 2 main perks.

More years of civilian service can:

Allow you to retire earlier

Increase your FERS pension

Retire Earlier

Buying back military time can often make you eligible to retire earlier because the eligibility rules are based on your age and years of service.

Under FERS, you have to meet one of the following to qualify for an immediate/unreduced retirement:

-Your MRA (minimum retirement age) with at least 30 years of service.

-Age 60 with at least 20 years of service.

-Age 62 with at least 5 years of service.

As an example, let’s say you are 57 (your minimum retirement age) and you have 20 years of civilian service. But you also have 10 years of military service which you bought back.

This will bring your total creditable service time to 30 years which would make you eligible to retire at 57 instead of waiting until age 60.

Increased Pension

Buying back military will affect your pension because your pension is also based on your years of service.

Here is the formula for calculating your FERS pension:

Years of Creditable Service x High-3 Salary x Multiplier

Note: As a traditional FERS (not special provisions), your multiplier will always 1% unless you are at least age 62 when you retire with at least 20 years of service at which point your multiplier will be 1.1%

For example, let’s say you have 20 years of service, a high-3 of $100,000, and a multiplier of 1%. Your annual gross pension would be calculated as follows:

20 x $100,000 x 1% = $20,000 Gross Annual Pension

To find out what this will be on a monthly basis, you will have to divide it by 12.

$20,000 / 12 = $1,666.66 Gross Monthly Pension

But as you might have noticed, I said “gross” monthly pension. There are a number of things that will come out of your pension before you’ll actually receive it and be able to spend it.

This article will go deeper into how this works.

But let’s also say that you again have 10 years of military service that you were able to buy back. This would increase your creditable service to 30 years and your new pension calculation would be as follows:

30 x $100,000 x 1% = $30,000 Gross Annual Pension

So in this example, your gross pension would be $10,000 more every single year in retirement just because you bought back your military time. It can make a huge difference!

How Much Does it Cost to Buy Back Military Time?

But just like most good things in life, there is a cost. And the cost will be based on your military base pay and when you served. The chart below shows the percentage of your basic pay that you’d have to pay to buy back your time during different years.

Source: https://www.opm.gov/retirement-services/fers-information/service-credit/#military

For most years, it will be 3% for FERS employees.

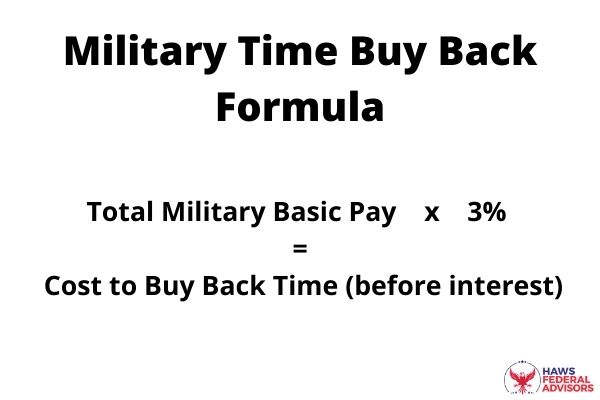

Here is the formula to calculate your military deposit (aka, what it costs to buy back your military time).

Total Military Basic Pay x 3%* = Cost to Buy Back Time (before interest)

*This will be higher than 3% for time between 1999-2000. See chart above.

So basically you need to add up every year’s basic pay and multiply that by 3%.

Here’s an example.

Let’s say you had 6 years of service back in the early 90’s and had the following basic pay during those years:

1990: $13,000

1991: $14,000

1992: $16,000

1993: $18,000

1994: $20,000

1995: $21,000

Total Basic Pay: $102,000

Note: Your Basic pay does not include allowances, flight pay, combat pay, etc.

This means that it would cost the following to buy back these 6 years before we think about interest:

$102,000 x 3% = $3,060 (before interest)

But Wait, There’s More!

But we are not out of the woods yet. Most federal employees will also have to pay interest on their deposit as well. The interest rate is different every year but as you can imagine, the longer you wait to buy back your military time, the more it is going to cost you.

Here is a chart showing the interest rate from previous years.

Source: https://www.opm.gov/forms/pdf_fill/opm1514.pdf

But with current interest rates being much lower than they were in the past, the variable interest rate for military deposits have been much lower in recent years. In 2021, it is 1.375%.

So basically, for every year (after the grace period which we’ll discuss below) that you work at your civilian job, the amount that you would owe, if you choose to buy back your military time, would increase per the amount of interest due that year.

And while the interest calculation can get a little hairy, the most important thing is that you buy back your time as soon as possible so as to not accrue more interest.

How to Buy Back Time Without Interest?

The government offers a grace period of 2 years from the day you started your civilian job to pay back your time without interest accruing. But because interest doesn’t start to accrue for a year after the grace period, in practice you actually have a 3 year grace period.

In a nutshell, if you pay your deposit within 3 years of starting your civilian career you won’t owe any interest.

But don’t worry if you are already passed the grace period. It often still makes a ton of sense to buy back your time even if you are paying a bunch of interest.

Pros and Cons of Buying Back Military Time

When thinking about buying back your military, it simply comes down to if the cost of making the deposit is worth the benefits you receive.

Let’s go through an example to show you what I mean.

Let’s say you are under the FERS system, have 24 years of service, and a high-3 of $110,000, then your pension calculation would look like this (assuming you were under age 62 at retirement time or else your multiplier would be 1.1%) :

$110,000 x 24 x 1% = $26,400 or $2,200 Per Month

When you buy back military time, that time is added back into your years of creditable service and thereby increasing your monthly pension. Using the same example as above, let’s say you have 6 years of military time that you decided to buy back which would then be added into your years of service. Your new pension calculation would look like this:

$110,000 x 30 x 1% = $33,000 or $2,750 Per Month

That is an extra $550/month or $6,600 per year, but the true difference is apparent when we look at the change over an entire retirement. Assuming you are retired for 30 years, that one decision to buy back your military time will put an extra $198,000 in your pocket.

The Cost

To get an idea of what it might cost to buy back these 6 years, let’s assume the following military basic pay:

1990: $13,000

1991: $14,000

1992: $16,000

1993: $18,000

1994: $20,000

1995: $21,000

Total Basic Pay: $102,000

$102,000 x 3% = $3,060 Deposit Owed (before interest)

To keep our numbers simple, let’s now assume the interest rate was 6% for the past 21 years.

Note: Interest has only accrued for the last 21 years of the 24 year civilian career because the first 3 were in the grace period.

This means the total military deposit that would be due with interest is about $10,400.

So in this example, it would cost you $10,400 to buy back our military time which then allows you to increase your pension by $6,600 per year for the rest of your life. You would earn your deposit back with 2 years of retirement! That is a great investment.

And on top of all of that, buying back your military would bump up your creditable service (in our example) to 30 years which would allow you to retire at your MRA (minimum retirement age) instead of waiting until age 60.

Does It Always Make Sense to Buy Back Your Military Time?

The short answer is ‘most likely’. In my experience, I have never seen a case where it hasn’t made a ton of sense to buy back military time.

Note: The one exception to this is when someone is already drawing military retirement. I address this situation in the next section.

But with that being said, you always want to run your own numbers to get an idea of what makes sense for you.

Should You Buy Back Your Military Time if You Have a Military Retirement?

If you are drawing a military retirement/pension you are allowed to buy back your military time but if you do then you will need to waive your military retirement once you retire from federal service.

For example, let’s say you did 20 years in the Army and are currently getting a monthly military retirement check. You now have 10 years of civilian service and are thinking about buying back your military time. If you decide to buy it back then you will have to make a deposit for that time as well as waive our military retirement once you leave federal service.

The net result is that your civilian retirement will be much bigger but you have to give up your military retirement.

So is it worth it?

Sometimes, but in my experience it isn’t most of the time.

One big reason that it often pays to keep your military retirement is that the COLA’s or cost of living adjustments are more generous (most of the time) for your military retirement than your civilian retirement.

This means that a military retirement will grow faster over time than your FERS pension.

But like always, you will want to run your own numbers to see if this makes sense for you.

How to Buy Back Your Military Time?

A great place to start when thinking about buying back your military time is to talk to your HR about the process. They can often point you in the right direction.

But here is a summary of what the process might like.

The first step is generally to fill out Form RI 20-97 which you will send to the appropriate military branch. This is done to get an official record of your military time and earnings.

That official record is used by your HR to give an estimate of what it will cost to buy back your time.

Your HR will send your application and other documents to your payroll office which will confirm the amount owed. They will then work with you to decide how you’d like to pay the deposit.

You can pay the deposit in a lump sum or over time via payroll deductions.

But again, the process may look a bit different for you depending on your agency and what documentation you have of your military service.

Common Questions

Can I Buy Back Military Time After Retirement?

No, you can not buy back military time after you retire. It has to be done while you are a federal employee.

Does Bought Back Military Time Count for The FERS Supplement?

No, in most cases bought back military time will not count when calculating your FERS Supplement.

Can I Buy Back My Reserve or National Guard Time?

You are able to buy back any active duty reserve or national guard time to count towards your civilian retirement. And unlike a military buy back, you are able to buy back active duty reserve or guard time without giving up your reserve or guard retirements.

Can I Buy Back My Military Academy Time?

Yes, you certainly can. And this time is often incredibly cheap to buy back because you are not paid much at all while at one of the military academies.