But Wait!!! A Simple calculator does not tell the whole story. Here is a guide to understanding your pension to make sure you can maximize it.

For most federal employees, your pension is a big part of your retirement. It is fixed income for the rest of your life. And that is becoming increasingly more valuable in a world where pensions are becoming a thing of the past (at least on the private side).

But it is essential that you completely understand how much you are actually going to get from your pension so that you can be prepared for retirement.

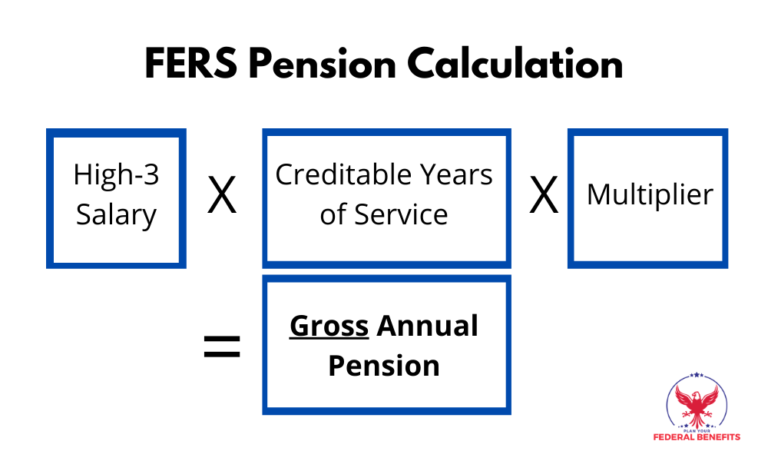

Every pay period, the government takes out a very small portion of your pay to go to your pension. However, the amount you receive from your pension is not based on how much you contributed over your career. It is based on the following three things:

- Your High-3 Salary

- Your Years of (Creditable) Service

- Your Pension Multiplier

When you multiply all of these things together, you get your gross annual pension as the picture shows:

The calculation is actually very simple. It gets a bit more complex when we look at each part of it. Let’s make sure you understand all of them.

Note: This is your GROSS pension, not what you’ll actually be able to spend in retirement. To get your net pension, you’ll take out things like taxes, survivor benefits, and FEHB premiums.

1. Your High-3 Salary

Your high-3 salary is the first component of the your pension calculation. Put simply, your high-3 is your highest average salary during 36 consecutive months of your career.

For many people, their high-3 comes from the last 3 years of their career because that is when they got paid the most. That being said, it is important to know that it doesn’t have to be the last 3 years of your career. Your high-3 will automatically be the 3 years that you had the highest pay regardless of when it occured in your career.

Note: Your high-3 does not have to be 3 calendar years (ie January-December). For example, if you had the highest average basic pay between May 2013 and May 2016 then that is the 3 years years that will be used.

How To Calculate Your High-3 Salary

Unfortunately, to calculate your high-3, not all types of pay are included. The type of pay this is included is called basic pay.

Basic pay includes the following:

-Your Base Salary

-Shift Rates

-Locality Pay

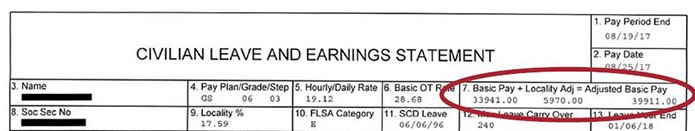

You can find salary information on your LES (Leave and Earnings Statement) in box #7.

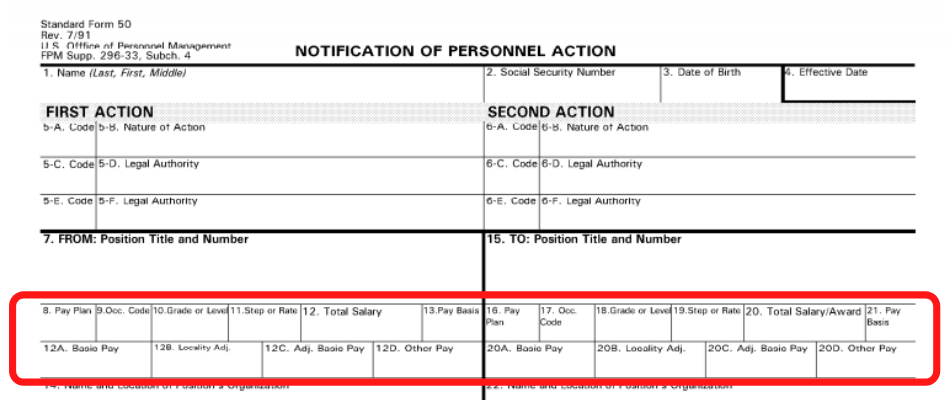

You can also find salary information on your SF-50’s.

However, basic pay does not include the following:

-Overtime Pay

-Overseas Cost of Living Adjustments

-Bonuses

-Cash Awards

-Travel Allowances

2. Creditable Service

Contrary to most federal employees initial thoughts, finding your correct amount of creditable service is often the most time consuming of all three.

The complexity stems from the fact that OPM calculates your creditable service from your standard form 50’s (SF 50’s). Even if you know that you worked 30 years, all that matters is what OPM thinks. This is why ensuring that your SF-50’s are all in your file and correct is so important.

And as you probably now, you have a lot of SF-50’s. You get issued a SF-50 every time there is a change in your job or pay. At a minimum you will have one SF-50 every year.

The best way to calculate your years of creditable service is by rounding up all your SF-50’s and making sure they match with what you think you have. This will help ensure that you are on the same page as OPM come retirement time. You’d be very surprised if you knew how often there are mistakes on SF-50’s.

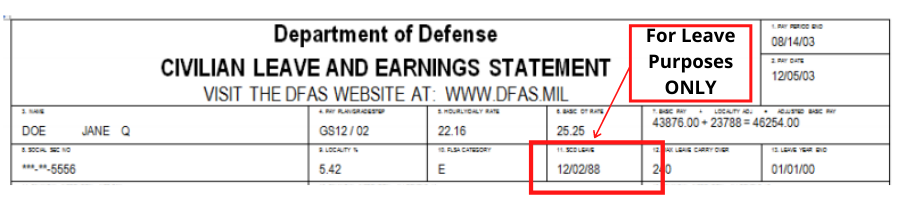

But What About My SCD (Service Computation Date)?

When many people look at their LES and SF-50’s, the find their SCD (service computation date). Most people assume that can be used to calculate their years of creditable service. Unfortunately, your SCD is for leave purposes ONLY.

The date that matters for your creditable service and pension calculation is your RSCD (Retirement Service Computation Date). This date matters because this is the date that OPM will use to calculate your retirement.

Unfortunately, there is no official document that shows your RSCD before you retire. Your Personal Statement of Benefits will have an estimate but that is just an estimate. You can use your SCD as an estimate as well but just know that it may be the same as your RSCD.

But again, OPM will calculate your RSCD from your SF-50’s. So you’d be able to calculate it by reviewing all your SF-50’s and finding the amount of time that you were official paying into the FERS retirement system.

Once you have your RSCD, calculate the amount of full years and months between that and your desired retirement date. Only full months count toward your creditable service so you’ll have to drop any extra days. 30 days is treated as a full month and OPM never rounds up.

For example, let’s say that the time between your RSCD and your planned retirement date is 22 years, 6 months, and 29 days. In this case, your creditable service would be 22 years and 6 months because the 29 extra days would drop off.

Be Extra Careful If...

If your career was consecutive with no breaks in service, odds are, your creditable service will be on the simpler side. But if you had a break in service, took leave with out pay, or had temporary time, you will want to be very familiar with the rules on how OPM handles this.

The worst case scenario would be to “retire”, find out from OPM that you don’t have enough creditable service, and have to come back to work. Proper planning now and help ensure that that sort of thing doesn’t happen to you.

What About Military Time?

As many people transition out of the military, they often find positions with the government on the civilian side. Military time can be “bought back” and added to your creditable service. For pension purposes, bought back military time will act as civilian service.

However, if you are currently drawings military retirement from your military time, you can not add that time to your civilian service without discontinuing your military pension. In a nutshell, you can’t double dip. Your military time can count towards a military retirement or a civilian one but not both.

3. Your Multiplier

Your multiplier is the easy part of the equation.

Your multiplier will be 1% unless you retire at age 62 or older with at least 20 years of service, at which point your multiplier would be 1.1% (a 10% raise!).

This bump in pension is often the incentive that many feds need to work just a bit longer. Do the math for your own pension to see what would happen if you worked until age 62 and 20 years of service.

FERS Pension Calculation Examples

Now that you know how the pension is built, let’s go over some examples.

And for the purpose of these examples, we’ll keep the numbers simple and clean. Let’s say your FERS Pension numbers look like this:

-High-3: $100,000

-Years of Service: 19

-Age at Retirement: 62

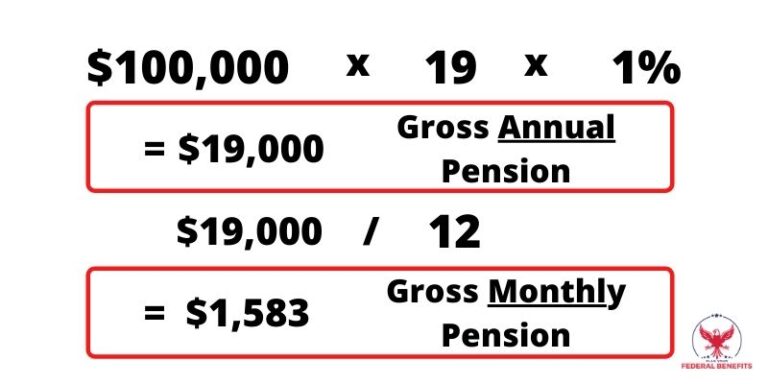

You did retire at 62 but because you only had 19 years of service, you don’t quite qualify for the 1.1% pension multiplier. If you would have worked one more year then you would have.

Note: If you have sick leave at retirement then it can push you over edge to qualify for the 62 and 20 years bonus.

So your pension calculation would look like this:

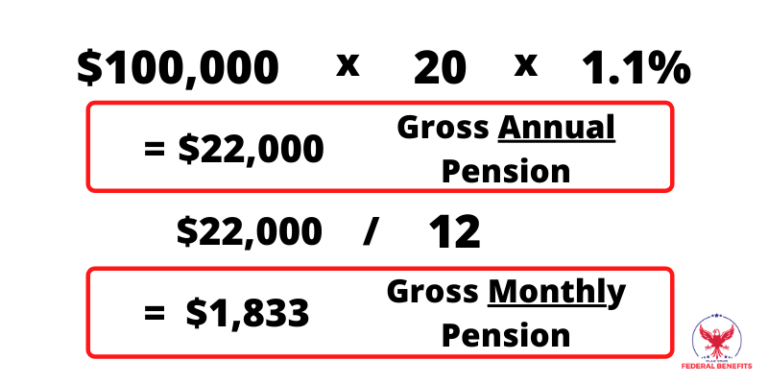

But now, let’s make one small adjustment. Let’s say that you did work one more year (until age 63) to get the full 20 years and be ellgiable for the 10% bonus in your multiplier. Your new pension calculation would look like this:

As you can see, working that one extra year added $3,000 of gross pension every year for life!

FERS Pension Calculator

Now, after all that, if you have an idea of what your FERS Pension number are, the next step is for your to calculate your own pension by multiplying your High-3 Salary by your Multiplier and Years of Creditable Service.

WARNING: Net Vs. Gross Pension

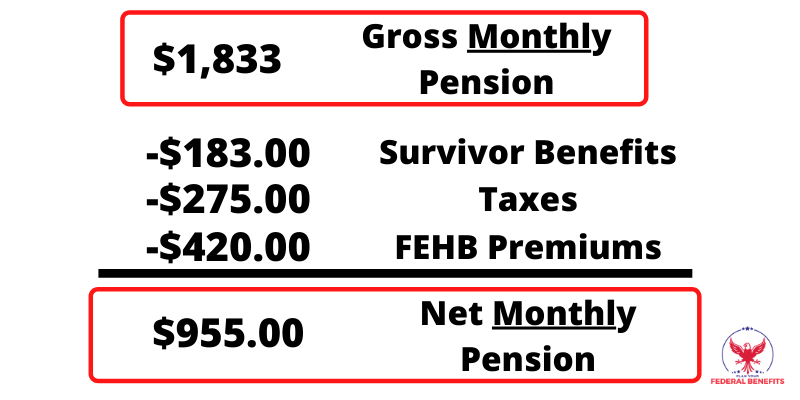

One of the biggest mistakes that FERS federal employees make when calculating their pension is that they calculate their gross pension and forget to think about their NET pension. Your net pension is the amount of money that you will actually be getting from the government after taxes and all the reductions get taken out.

There are 7 possible reductions to your pension but here is an example with the most common:

As you might imagine, many people are shocked when they see the difference between their Gross pension and their Net pension. But understanding the difference will make a huge difference in your retirement planning.

You can find an example of how this reduction will work here.