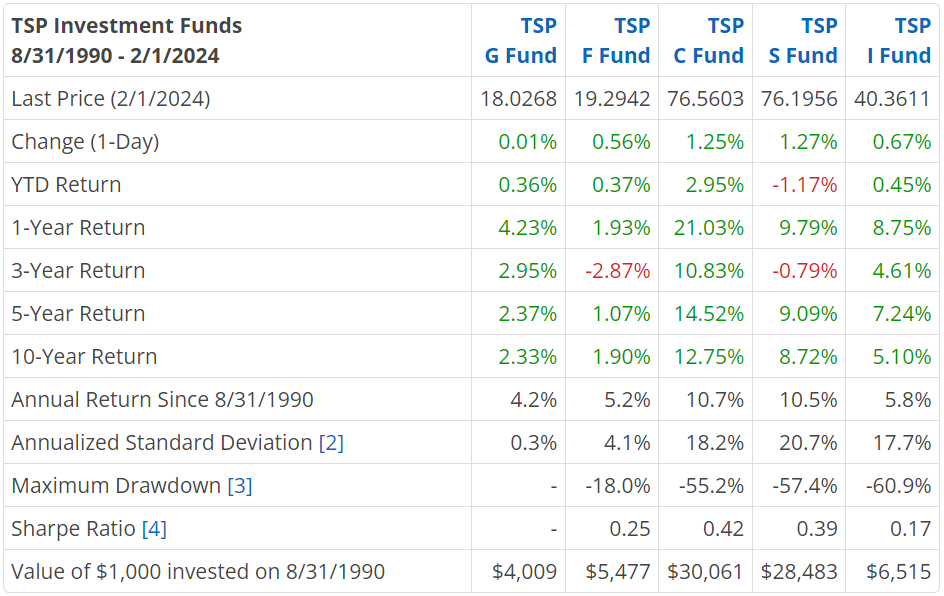

Primary TSP Funds Return

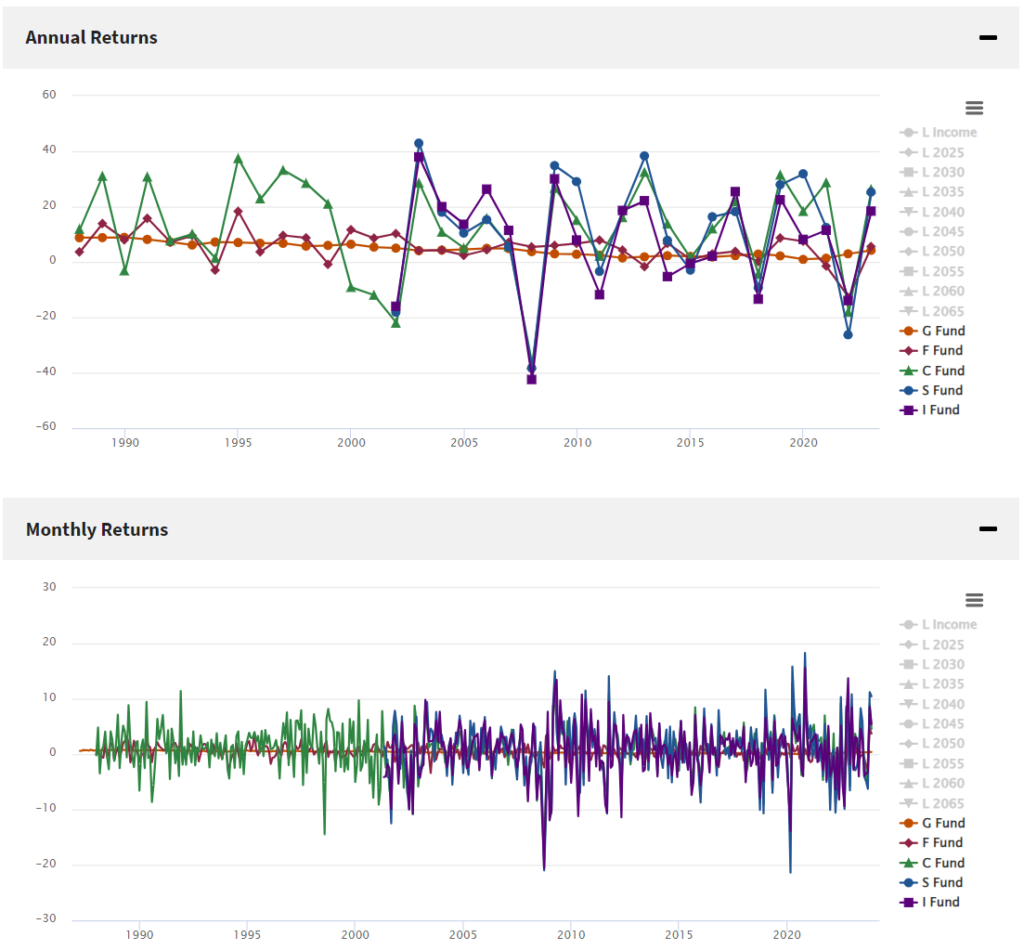

There are many TSP funds. The first TSP fund returns we will look at are the primary funds (G, F, C, S, and I funds).

Source: https://www.tsp.gov/fund-performance/

Observations:

The G and F fund are more conservative. The vast majority of the time the G and F fund are great short-term investments. If you are looking to make a lot of money in the long-term, these funds are not a great strategy for that.

The C, S, and I funds are more aggressive. These funds will vary day-to-day but they are great long-term strategies. Over time they will provide a greater profit than the G and F funds.

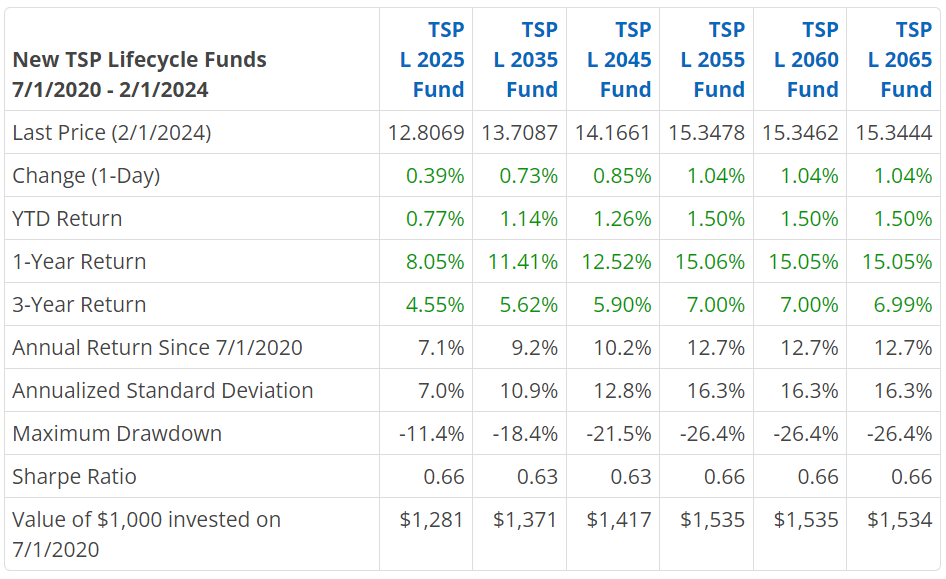

Lifecycle Funds (L-Funds) Return

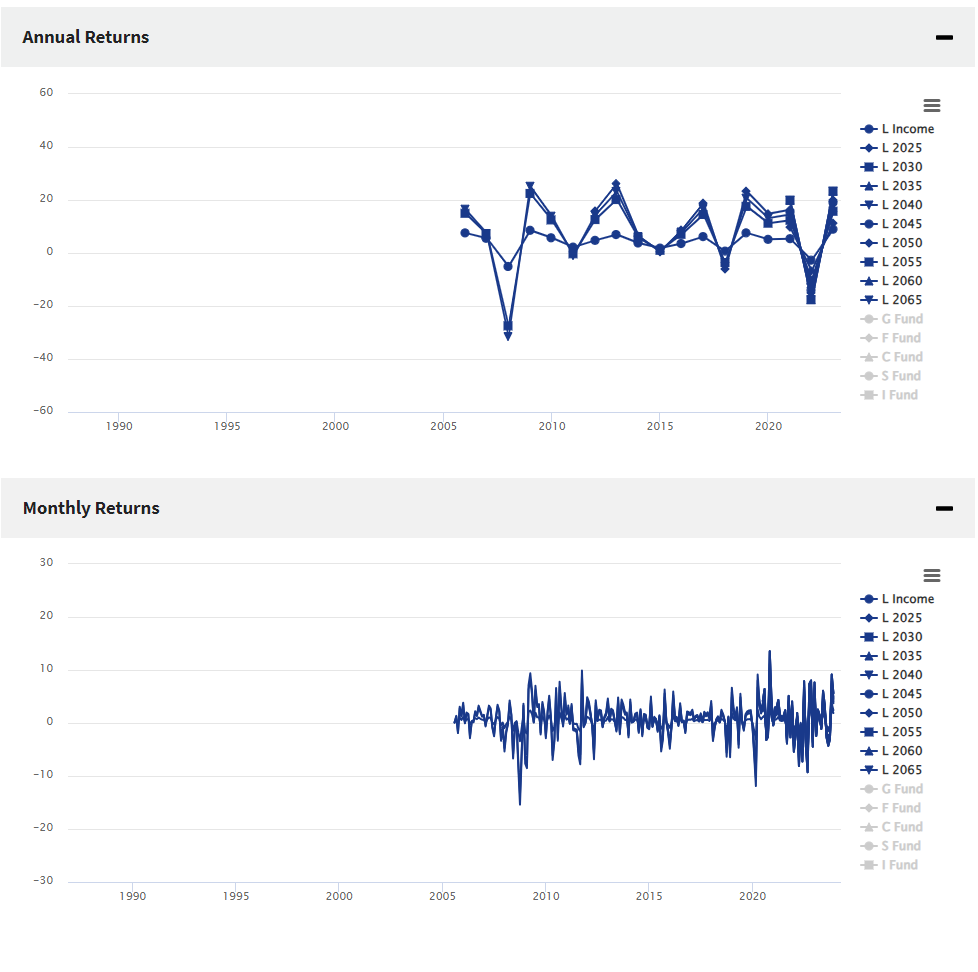

The L-Funds are the next funds we will observe. There are 10 different L-funds. All these funds are different combinations of the G, F, C, S, and I funds.

Source: https://www.tsp.gov/fund-performance/

Observations:

The L-funds are a combinations of the G, F, C, S, I funds. Compared to the G, and F funds, the L-funds are not as great for short-term investments. And compared to the C, S, and I funds, the L-funds are not as great for long-term investments.

If you are looking for something in between a short-term investment and a long-term investment, the L-funds would a combination of those.

Looking at the individual L-funds, the higher the L-fund is the more aggressive it becomes generally. And the lower the L-fund is, the more conservative it is generally.

Key Takeaway

Each fund can be useful depending on what kind of investment you are looking for. There’s funds better for short-term investments and others better for long-term investments and others that are a combinations of those investments.

If you are early in your career, the more aggressive funds are probably better for you. If you are almost retired and about to take money from you TSP, it might be helpful to put a little in the more conservative funds while keeping a majority in the more aggressive funds.

Some funds work for others while it may not work for you. It is your job to assess your situation in life to see what works. Thank you for taking charge of your federal career and retirement.