Do you like saving 30%-40% on something that you are going to buy anyway? I know I do.

That is exactly what a FSA (Flexible Spending Account) and a HSA (Health Savings Account) help you do.

But the sad part is that if people understood the key differences between a FSA and a HSA they can often save thousands more every year but unfortunately, most people don’t know what they don’t know.

This article will dive deep into how you can take advantage of all these savings ASAP.

Why Should You Care?

Both these accounts allow you to pay for medical expenses with pre-tax money. Exciting, right? 🙂

Let me explain.

When you contribute money to a FSA or HSA you get a tax deduction (we like paying less taxes) and as long as you use the money to pay for qualified expenses then the funds can come out of these accounts completely tax-free.

This means that you often save between 30%-40% on medical expenses because you avoid not only income tax but Social Security and Medicare taxes as well.

For example, let’s say there is an expense that is going to cost you $1,000 out of pocket. If you don’t use a FSA or HSA then you would actually have to earn about $1,500 (will vary depending on tax bracket) to then be left with $1,000 after about a 30% tax haircut for income (federal and state), social security, and medicare taxes.

However, by using a FSA or HSA, you avoid taxes and only need to earn $1,000 and therefore save $500 easy peasy.

But like I said before, there are some major differences between an FSA and HSA and these differences are big!

Let’s dive into the fun stuff.

Feel free to jump to the section that most interests you:

-Can I use both an FSA and HSA at the same time?

-Is a HSA worth being in a HDHP (high deductible health plan)?

FSA (Flexible Spending Account)

How much can you contribute?

In 2024, you can put up to $3,200/year into a FSA.

How much rolls over into the next year?

In 2024, you can only roll over $640 into the next calendar year. This means that if you have more than $640 in your FSA come the end of the year then you will forfeit the excess.

Note: You can rollover an unlimited amount year-to-year in an HSA. See more below.

Can I invest my FSA account?

Nope, sorry. But you can with an HSA. See more below.

What expenses can be paid from an FSA?

Medical expenses: co-pays, co-insurance, and deductibles

Dental expenses: exams, cleanings, X-rays, and braces

Vision expenses: exams, contact lenses and supplies, eyeglasses, and laser eye surgery

Professional services: physical therapy, chiropractor, and acupuncture

Prescription drugs, insulin, and prescribed over-the-counter medicine

Over-the-counter health care items: bandages, pregnancy test kits, blood pressure monitors, etc.

What is the catch of an FSA?

Like I mentioned above, you can only roll so much of your FSA money over to a new calendar year. And if you change employers or retire you forfeit your FSA all together.

HSA (Health Savings Account)

How much can you contribute?

In 2024, the HSA contribution limit is $4,150 for self-only and $8,300 for families. Also, if you are older than 55 you can make a catch-up contribution of another $1,000.

How much rolls over into the next year?

There are no limits for how much can rollover year-to-year so you can (and many people do) accumulate lots of mula in these accounts. Some people accumulate $100,000+ in their HSAs over their career.

And even if you change plans, jobs, or just retire you take your HSA with you. Yay!!

Can I invest my HSA account?

Yep, you sure can. This means that your HSA can grow over time and this is often the key for people who have large balances.

Pro Tip: Some people even choose to spend minimally from their HSA during their career in efforts to have a large tax-free bucket of money for medical expenses in retirement.

What expenses can be paid from an HSA?

HSAs will cover basically all the types of expenses that an FSA will but it also tends to cover more things as well.

Some of the extra things it covers are:

-Medicare premiums

-Long term care insurance premiums

-Non-prescription services like a massage

You can check with your HDHP provider if you have a question about what you can use your HSA for.

What is the catch of an HSA?

So far you might have noticed that an HSA is better than an FSA in almost every way so why doesn’t everyone use it?

Because not everyone can.

To contribute to an HSA you have to:

-Be enrolled in a HDHP (High Deductible Health Plan)

-Can’t be enrolled in Medicare, Tricare, or other non-HDHP

-Can’t be claimed as a dependent on someone else’s tax return

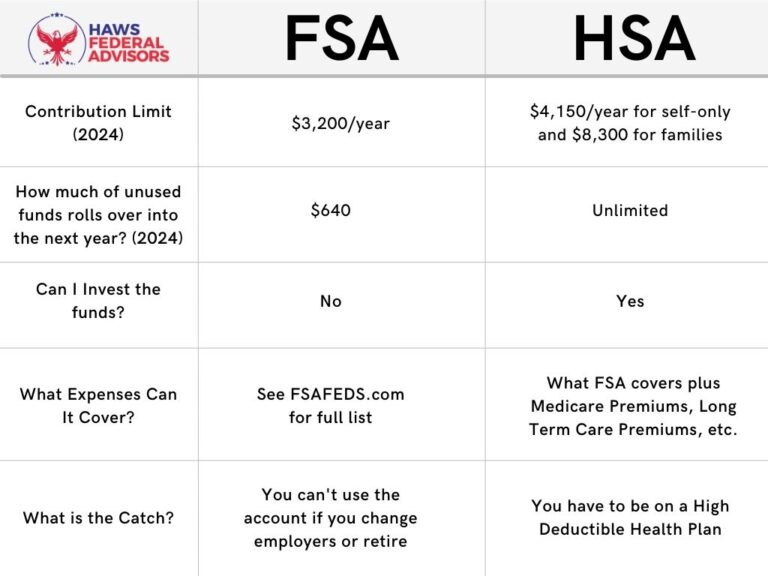

HSA vs. FSA Comparison Chart

Can I use both an FSA and HSA at the same time?

Nope, these two accounts are mutually exclusive. You only can use one or the other.

However, have you ever heard of a LEXFSA? Don’t worry. Most people haven’t.

A LEXFSA is similar to a FSA but you can only use the money on Dental and Vision expenses.

However, you can use a HSA and a LEXFSA at the same time!!

Not so Scary Facts of High Deductible Plans

The biggest reason that someone chooses not to use an HSA is often because they are scared to get on a HDHP.

But most people find that they aren’t nearly as scary once they actually dive into the details.

The core concept of a high deductible plan is that it takes a higher level of expenses every year for the insurance company to start paying out. But in return you get lower premiums and you get access to an HSA.

Or in other words, you cover more of the smaller expenses and the insurance company kicks in for the bigger expenses.

Note: Preventative care is usually still covered 100% on HDHP even before you have met your deductible.

Also, many times the HDHP provider will also contribute money into your HSA account as well to help cover any out of pocket expenses.

Not to mention, many HDHP available to federal employees (FEHB) actually have lower maximum-out-of-pocket limits than non-HDHP plans.

This means that if you had a year with high medical expenses then you’d actually owe less out of pocket with a HDHP plan (assuming the maximum-out-of-pocket limit was lower).

I have seen people save thousands of dollars year after year just by making the switch to a HDHP.

When a High Deductible Plan Doesn’t Make Sense

But like everything in personal finance, a HDHP doesn’t make sense for everyone.

If someone has consistently high medical expenses and always hits their deductible every year, they may be better off with a non-HDHP.

Or if someone is on Medicare they will probably want a FEHB plan that is designed to merge with Medicare.