If you are planning to retire and never work again (for money) then things are pretty simple for you.

But if you are planning to work in retirement there are some major pitfalls you are going to want to avoid.

Don’t Fail The Test

Both the FERS supplement and Social Security have an earnings test.

An earnings test simply means that if you are working for money (either in a job or by running a business) and receiving the FERS supplement or Social Security at the same time then the government may reduce or eliminate your FERS supplement or Social Security.

But the earnings test only kicks in once you make over the earnings limit.

In 2024 you can make up to $22,320 without your FERS supplement or Social Security being affected.

But for every $2 you make over the limit ($22,320) your benefits will be reduced by $1.

For example, if you make $10,000 over the limit ($32,320 total) then your FERS Supplement or Social Security would be reduced by $5,000.

Exceptions!!

But for every rule there are always exceptions.

Social Security Exception

Social Security is subject to an earnings test until you hit your FRA or Full Retirement Age (which is 66-67 for most people) and then there is no earnings test.

So you can make as much money as you’d like after your FRA and your Social Security won’t be affected.

So many people that are planning to work in retirement often don’t start Social Security until at least their FRA.

FERS Supplement Exception

If you are a Special Provision employee (air traffic controller, law enforcement, fire fighter, etc.) then your FERS Supplement doesn’t have an earnings test until you hit your MRA or minimum retirement age (which is around age 57).

So if you retire at age 52 then you won’t have to worry about an earnings test until you hit your MRA which is around 57 for most people.

Brackets Brackets

Outside of earnings tests there are two more things to watch out for when working in retirement.

Tax brackets and medicare brackets.

Tax Brackets

Whenever you make more money then that could put you in a higher tax bracket.

Having retirement income and income from work can put you in a higher bracket than you are used to.

However, making more money is almost always worth it but you’ll just want to make sure you understand what tax bracket additional income will put you in.

Medicare Brackets

Medicare has two parts that most feds use: Part A and B.

Part A is free but Part B has a premium. And the premium amount varies based on income.

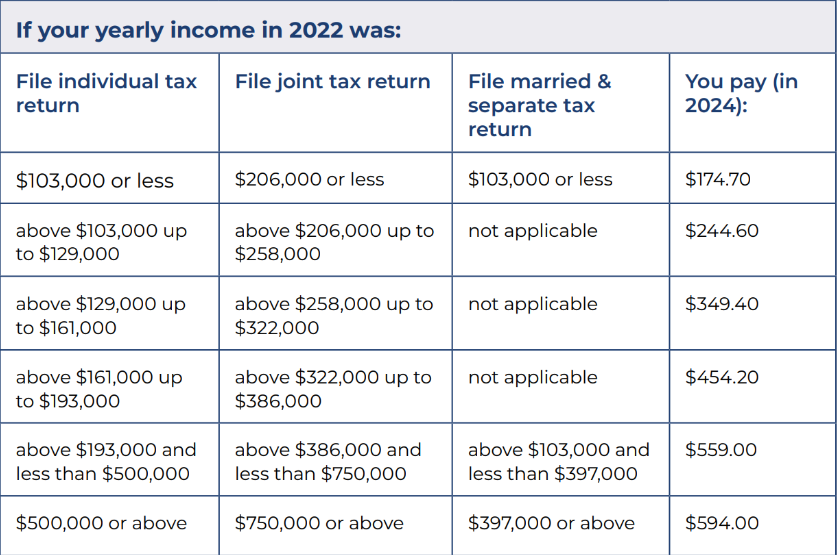

The higher your income the higher your Medicare part B premium.

So making extra money from a job may not only increase your tax bracket but also what you pay for Medicare as well.

Here is a chart that shows how 2024 Medicare Part B premiums go up with income:

Source: Medicare

But Don’t Forget

Having a job or business in retirement can be a great thing. It often provides the needed structure and extra cash for a great retirement.

But it is always important to know what impact this extra income will have on the other aspects of your life.