The FERS Supplement is a great benefit for many federal employees that retire before age 62.

But unfortunately, there is still a lot of misunderstanding and misinformation about this benefit. One of the most confusing parts is that this benefit is called many different things.

Here are some of the popular names:

-The FERS Supplement

-Special Retirement Supplement or SRS

-Annuity Supplement

-Social Security Supplement

These different names may show up across the internet and on documents such as pension estimates from your HR. For the purposes of this article, I will call it the FERS supplement.

Feel free to jump around the different sections that you are interested in.

–Who is Eligible for the FERS Supplement?

–How to Calculate the FERS Supplement?

–FERS Supplement Calculation Example

–Is The FERS Supplement Taxed?

–Reductions to the FERS Supplement

–Common Questions About The FERS Supplement

What is The FERS Supplement?

This supplement is paid to those FERS federal employees that retire before age 62 and they will continue to receive it until the month that they turn 62. So if someone retires at 57 then they will receive the FERS supplement for 5 years while a 61 year old retiree will only receive the benefit for 1 year.

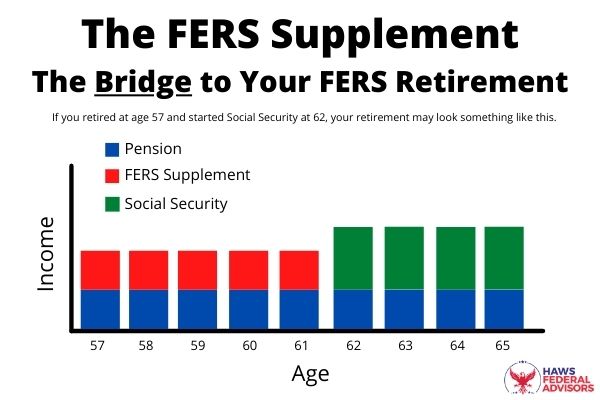

This benefit was designed to bridge the gap between when some federal employees retire and when they are first eligible for Social Security at 62.

Related Content: The Gap That Will Kill Your TSP

Do I Have to Start Social Security at Age 62 Once My FERS Supplement Stops?

You can start Social Security any time between age 62 and age 70. Your FERS supplement payment will stop at age 62 regardless of when you choose to turn on Social Security.

And many federal employees find that it makes sense to delay Social Security past age 62 because of the increased monthly benefits that come along with it.

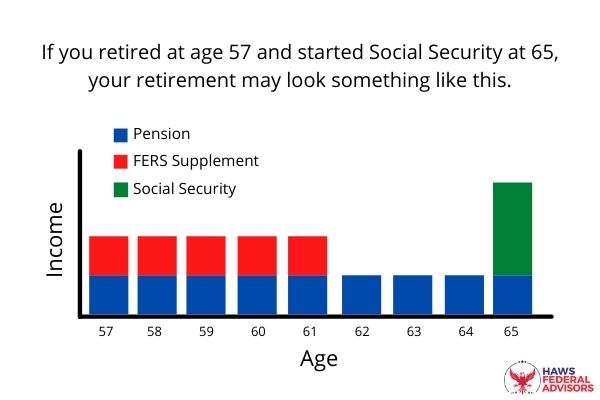

If you are eligible for the FERS supplement and choose to delay Social Security benefits until age 65, your retirement income may look like this.

Related Content: Should You Start Social Security Right as Your FERS Supplement Ends?

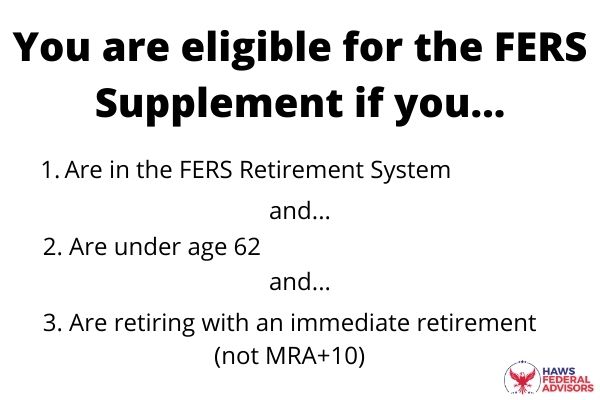

Who is Eligible For the FERS Supplement?

Unfortunately, not all FERS are eligible to get the FERS supplement.

Here are the 3 eligibility requirements for this benefit.

Be under FERS (not CSRS)

Be younger than age 62

Retire with an immediate retirement (not MRA+10).

The FERS supplement, as the name suggests, is only for those under the FERS system and CSRS employees are not eligible.

As stated above, you are eligible for an immediate retirement at age 62 with 5 years of service but because the FERS supplement only pays until age 62, this type of retirement is not eligible for the FERS supplement.

You must retire with an immediate retirement to be eligible for this benefit.

And for those that are unfamiliar, here are the eligibility rules for an immediate retirement.

You must meet at least one of the 4 criteria

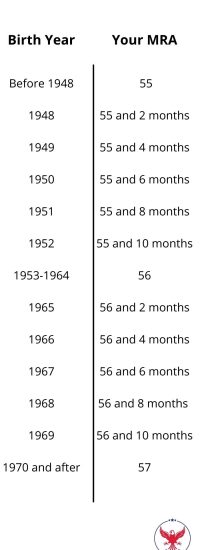

Reached your MRA (minimum retirement age) with at least 30 years of service.

Note: Your MRA is based on the year you were born per the chart.

Reached age 60 with at least 20 years of service.

Reached age 62 with at least 5 years of service.

Reached your MRA (minimum retirement age) with at least 10 years of service.

While this last option is considered an immediate retirement, it does not qualify you for the FERS supplement

How to Calculate The FERS Supplement?

The next step is to understand how to calculate the FERS supplement.

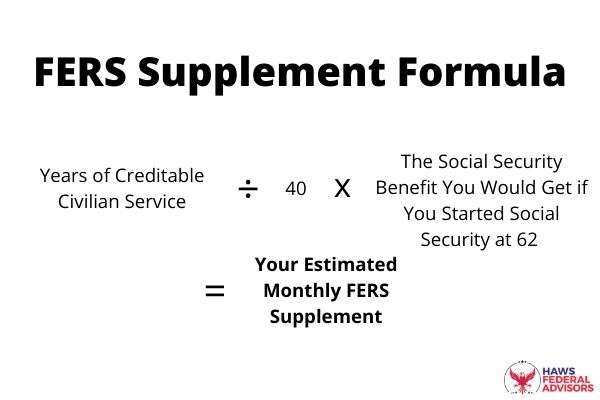

The formula takes your years of creditable civilian service, divides it by 40 and then multiplies that by your age 62 Social Security benefits. This picture shows the formula.

Note: Your years of creditable service for this formula does not normally include military time that you bought back. The only type of military time that counts for the FERS supplement is service that was a period covered by military leave with pay or leave without pay from civilian service.

Why 40?

The 40 in the formula is fixed and does not change.

Where Can I Find My Age 62 Social Security Benefits?

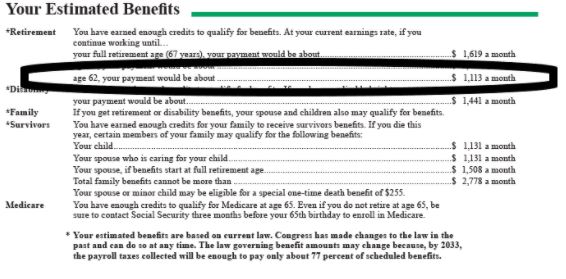

The easiest way to find this is on the second page of your Social Security statement. If you don’t have a Social Security statement you can request one by making an account at ssa.gov.

Here is an example of a portion of the second page of a Social Security statement where you can find your age 62 benefit.

FERS Supplement Calculation Example

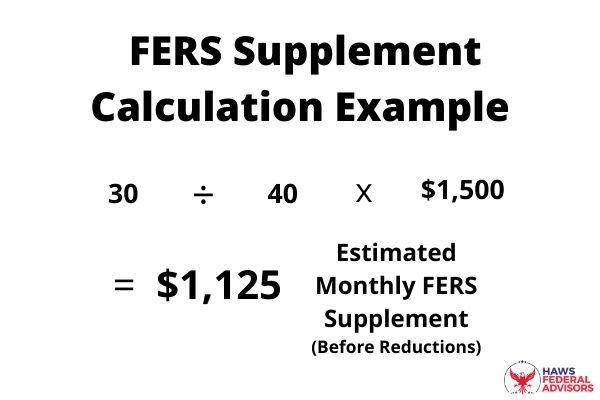

Now that you know the formula let’s go through an example of what the numbers might look like.

Let’s say that you have met your MRA (minimum retirement age) of 57 and you have your 30 years of service. You are also under FERS so you are eligible to receive the FERS supplement.

If your age 62 Social Security benefits was $1,500 then your FERS supplement calculation would look like this:

Years of Service / 40 x Age 62 Social Security Benefits

30 / 40 x $1,500 = $1,125 = Monthly FERS Supplement

But I have some good news and bad news.

The good news is that now you know how to calculate your FERS supplement. The bad news is that that is only your gross FERS supplement and not your net.

There are a couple things that might come out of your FERS Supplement before you ever actually see the money.

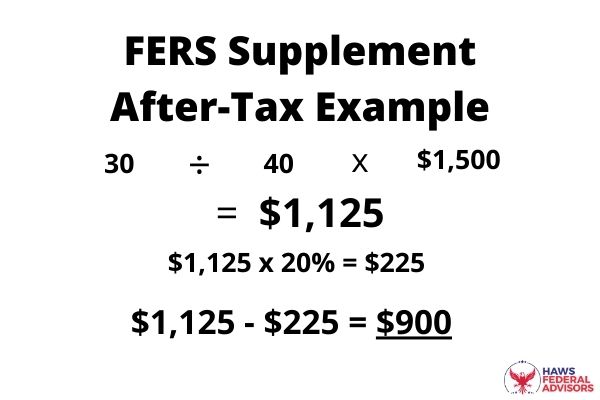

Is The FERS Supplement Taxed?

Yes, it certainly will be taxed. And unlike Social Security, 100% of your FERS supplement will be subject to tax.

Note: For those that don’t know, “only” up to 85% of your Social Security can be subject to taxes.

So if we assume that you have tax withholding of 20% then your FERS supplement calculation will look like this.

As the picture shows, with a tax rate of 20% your FERS pension will go from a monthly $1,125 to $900 after tax.

But it is important to remember that your specific tax rate will depend on your income in retirement as well as the tax law at that time.

Related Content: Myths About Taxes in Retirement

Related Content: The States That Won’t Tax Your Fed Retirement Income

Reductions to The FERS Supplement

But even after we have thought about taxes we aren’t out of the woods yet.

If you have “earned income” over certain limits then your FERS supplement will be reduced or completely eliminated.

But the good news is that most income in retirement does not count as “earned income” for the purposes of this rule. Earned income generally only includes W2 income (so if you get another job) or income from a business.

So your pension or distributions from your TSP will not count as “earned income.”

Here is OPM’s statement on this:

Source: https://www.opm.gov/retirement-services/publications-forms/pamphlets/ri90-8.pdf

This reduction to your FERS supplement is very similar to the reduction that you could see to your Social Security benefits if you choose to start Social Security before your full retirement age (between age 65-67) and have any “earned income”.

How Much Can My FERS Supplement Be Reduced By?

Here is how the reduction works.

For every $2 that you make over the annual income limit (this limits changes every year) your FERS supplement will be reduced by $1.

In 2020, this limit was $18,240 and in 2021 this limit is $18,960.

And because the earnings limit is so low even a part-time job in retirement could be enough to significantly reduce your FERS supplement.

FERS Supplement Reduction Example

Let’s say that you have $25,000 of earned from either a part-time job or business and are currently receiving the FERS supplement.

$25,000 is ($25,000 – $18,960) $6,040 over the 2021 earnings limit so that means that your FERS supplement will be reduced by ($6,040 / 2) $3,020 the next year.

This comes out to a reduction of about $251 per month. So if you had previously been receiving $1,200 per month then that will be reduced down to $949.

When Does the Reduction Occur?

Every spring OPM sends out an earnings survey to all those that had received the FERS supplement during the previous year. This is how OPM knows about your earned income and how much they should reduce your supplement by.

Any reductions that do occur will start in July of the following year that you had “earned income” over the limits.

For example, if you earned over the limit in 2020 then your FERS supplement would not be reduced until July 2021. The reduction would then continue from July 2021 until June 2022.

Related Content: Read This Before You Get a Job in Retirement

Common Questions About the FERS Supplement

How to Apply for FERS Supplement?

There is no application for the FERS supplement. If you are eligible for it then OPM will automatically include it in your pension payment every month.

How Will I Receive the FERS Supplement?

The FERS supplement is paid in the same payment as your FERS pension except while you are receiving interim payments. See next question for details.

How Long Does It Take To Get The FERS Supplement?

It can take OPM many months to process your entire retirement application. Once they do an initial check on your application then they will start sending interim payments that are typically 60%-70% of your full pension amount.

Once OPM has processed your entire application then they will back pay you for anything they missed and will start paying you your full pension amount as well as your FERS supplement if you are eligible. It is not unusual for this process to take 6-12 months.

So as a summary, your FERS supplement will not be included in your interim payments and will only start being paid until your entire application is processed which can take some time.

Will the FERS supplement be eliminated?

There has been much talk over the years in Congress to potentially eliminate the FERS supplement. While I can’t speak for the future, the FERS supplement is still currently available as of the publication of this article.

How Long Does The FERS Supplement Last?

If you are eligible for the FERS supplement then you will continue to receive it until the month that you turn 62.

Warning about FERS Supplement

The FERS supplement is a great benefit that can help many federal employees retire early. But as this article has shown, there are many complexities to this benefit and you will want to make sure that you understand exactly how it will work for you.

Does The FERS Supplement Force Me to Take Social Security at 62?

No, you don’t not have to take Social Security at 62 once your FERS Supplement stops. However, your FERS Supplement will stop regardless of when you do decide to take Social Security so if you don’t take it at 62 then you might have to fill that income gap some other way.